E-Mobility Benchmarking Analysis

Who is really leading the way?

Electric mobility is no longer a future concept – it has already taken over the automotive market and is changing it for good. While some manufacturers are driving developments forward, others are still grappling with the challenges of this transformation. Who holds the competitive advantage, and who is falling behind expectations? What are the leading automotive manufacturers doing to stay successful in electric mobility?

Our latest E-Mobility Benchmarking delves into these questions. We've researched the European market, closely examining the major automotive manufacturers in Germany. Our analysis goes beyond just sales figures – we’ve also explored how extensively manufacturers are addressing the entire user experience of electric mobility. It’s not just about the vehicle – charging infrastructure, innovative additional services, and integration into the energy market are just as crucial today.

What does the analysis deliver?

Our benchmarking provides clear answers to the key questions in the industry:

- Who dominates the German market? Which manufacturers are truly leading in the field of electric mobility, and where are there untapped opportunities?

- How innovative are the vehicles? What technologies are the leading brands implementing, and how do they perform on key criteria such as range, charging times, and battery capacity?

- How well developed is the charking infrastructure? How well are we really prepared in terms of charging infrastructure – and what are the manufacturers offering in this area?

- What additional services do manufacturers offer? Which manufacturers go beyond the vehicle itself and offer additional services that make owning an electric vehicle even more attractive?

Curious about the results?

Explore the key insights from our analysis and find out how you can elevate your electric mobility strategy to the next level.

Stay tuned. In the coming weeks, we will release deeper insights into various aspects of our analysis, showing you where the real opportunities lie. We’d be happy to share them with you directly – Emilia Juraschek is available for any inquiries. You can find her contact details in the section below.

Objective comparison

- Direct comparison of leading manufacturers based on key factors: market share, vehicle features, charging infrastructure, and services

- Industry-proven benchmarks for real-world application

- Comprehensive overview of market leaders’ strengths and weaknesses, along with opportunities for strategic development

Your strategy in focus

- Analysis of the competitive landscape in the rapidly growing electric mobility market

- Key topics: user-friendliness, innovative mobility services, expansion of charging infrastructure

- Goal: strengthening your market position and targeted development of your electric mobility portfolio

Strategic insights

- Market Assessment of the competitive landscape in e-mobility

- Key topics for advancing e-mobility: Optimising user experience, expanding innovative services, and developing charging infrastructure

- Valuable insights for strategic decision-making based on our analysis

Clarity through categorisation

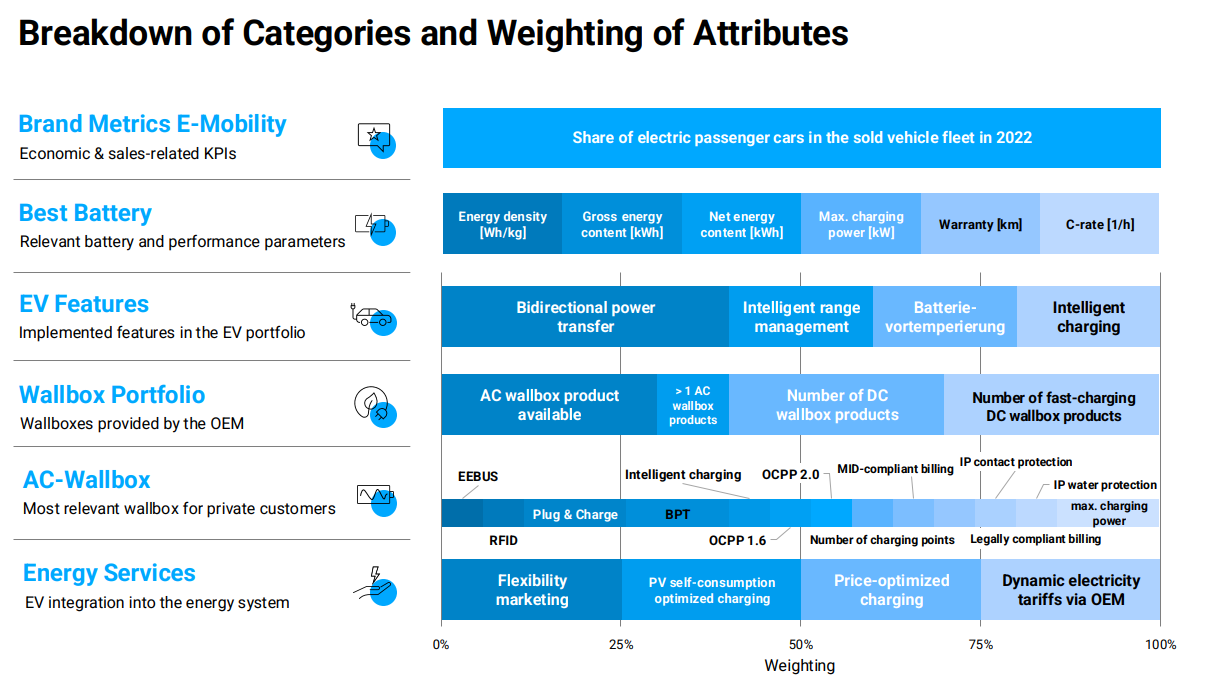

Our analysis clearly highlights the differences between the leading electric vehicle manufacturers. The results are structured into distinct categories, allowing for a precise comparison:

- Market Share within total vehicle sales

- Best Battery performance

- EV Features

- Wallbox Portfolio

- AC Wallbox

- Energy Services

While market share and battery characteristics can be directly compared, we have developed a scoring system for categories that are more difficult to quantify. This approach enables a well-founded overall assessment of manufacturers.

Points are awarded based on the availability of specific features. Additionally, weighting within each category allows for a quantitative evaluation, providing a comprehensive ranking of individual automotive manufacturers.

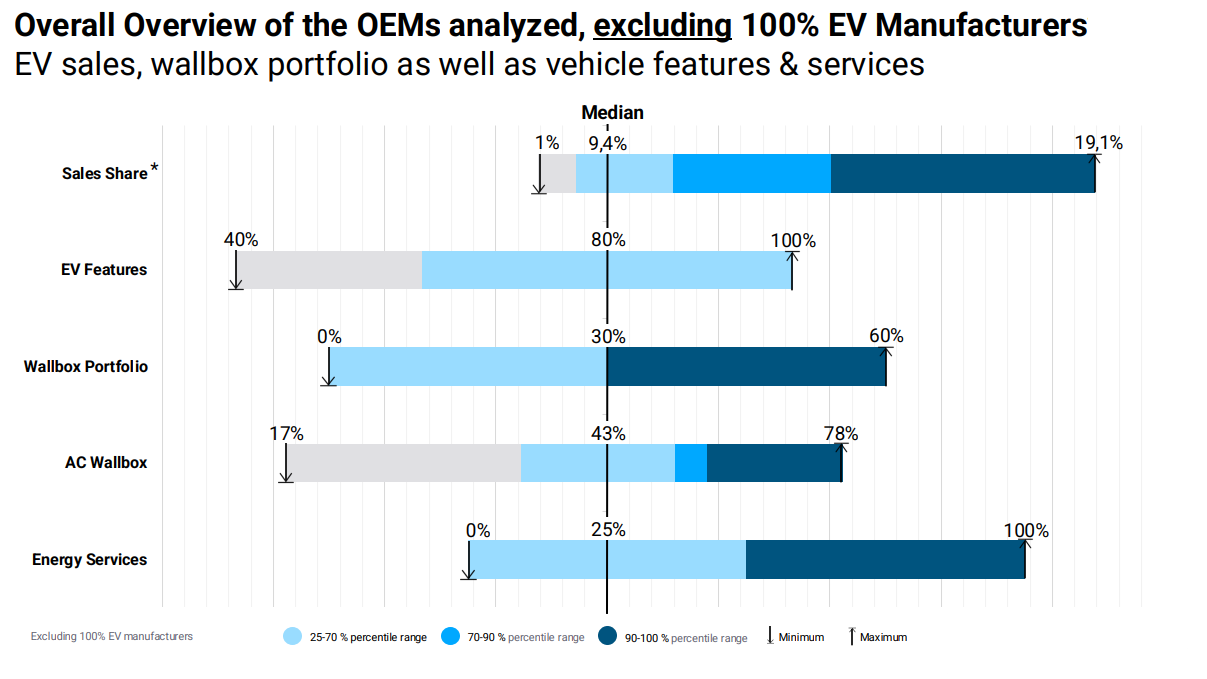

What do percentiles indicate?

Throughout our analysis, we frequently refer to percentiles to provide a clearer picture of where manufacturers stand in comparison to the overall data distribution. These insights are further enhanced through informative visual representations.

Percentile boxes help illustrate results in relation to the entire dataset, allowing for a precise classification of automotive manufacturers.

- The 50th percentile (median) indicates the value at which 50 % of manufacturers fall below or are equal, while the other 50 % are above.

- Similarly, the 30th, 70th, and 90th percentiles can be determined, offering additional reference points.

- The 100th percentile represents the highest value achieved by any manufacturer – the maximum.

The range between the 90th percentile and the maximum is visualised as the 90-100% percentile box. Its width indicates the level of variation among the top 10 %:

- A wide box suggests significant differences in performance within the leading group.

- A narrow box implies that the top manufacturers achieve very similar results.

EV market share: Untapped potential remains

One example from our analysis illustrates the significant differences in the share of electric vehicles (EVs) within the total sales of various manufacturers in 2022.

- Manufacturers like Tesla and BYD, which exclusively produce electric vehicles, naturally achieve a 100 % EV share.*

*To present an authentic picture of the traditional automotive industry, we have deliberately excluded these pure EV pioneers from our representation of sales shares. This ensures a representative and meaningful depiction of the established manufacturers on their path to an electric future. - For traditional manufacturers still selling internal combustion engine (ICE) vehicles, the range is much broader: One manufacturer recorded just 1 % EV sales, while another achieved up to 19.1 %

- The median share among all examined manufacturers stands at 9.4 %, meaning half of the manufacturers sold 9.4 % or fewer electric vehicles.

The gap within the top 10 % of conventional manufacturers is notable. The leading brands reach an EV share of at least 15%, yet more than eight out of ten vehicles sold still have combustion engines.

A manufacturer with just 1 % EV sales faces mounting pressure to adapt its strategy to remain competitive and avoid falling behind in an increasingly electrified market.

E-Mobility: growth potential and future outlook

The electric vehicle market still holds significant growth potential. A median EV sales share of 9.4% highlights that the industry is still in the early stages of its transformation. Given the ambitious EV sales targets set by many manufacturers and the increasing convergence of the energy and automotive industries, now is the time for strategic decisions.

As the transition accelerates, expert guidance is more critical than ever—and that’s where we come in. With our deep industry expertise, we help you develop a future-proof e-mobility strategy tailored to your goals.

Interested in learning more?

Stay tuned for upcoming insights, or get in touch to drive your e-mobility strategy forward. We’re here to help you navigate the transition and set the right course for success.

Deep dive into the e-mobility benchmarking analysis

In the upcoming publications of our E-Mobility Benchmarking, we will delve deeper into the analysis results of the following categories:

Best Battery

How do car manufacturers differ in one of the most crucial aspects of their vehicles – the battery? In this edition, we examine key characteristics such as energy density, storage capacity, and maximum charging power, presenting the results of our benchmarking.

EV Features

The equipment and features of electric vehicles play a decisive role in their market acceptance. In this edition, we take a closer look at essential functionalities, such as smart charging based on self-generation or market price signals, intelligent range management, battery pre-conditioning, and the possibility of bidirectional charging. These features directly impact a vehicle’s attractiveness and success in the market.

Wallbox Portfolio

In the fourth edition, we shift the focus from vehicles to an essential accessory: the private wallbox. We analyze the number of available models, the specific features these wallboxes offer, and how they are integrated into service offerings.

Energy Services

In the fifth and final part of our E-Mobility Benchmarking series, we turn our attention to the energy sector and the additional value creation potential arising from the connection between electric vehicles and wallboxes. In the Energy Services category, we examine topics such as optimizing self-consumption by using EVs as buffer storage, offering dynamic electricity tariffs, and utilizing flexibility marketing, where stored energy in EVs is deployed for grid-supporting purposes – both unidirectional and bidirectional.

I am excited to share more about

our E-Mobility Benchmarking!

Feel free to reach out

for further information.

Consultant